Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

Spanish small and medium-sized enterprises (SMEs) face crucial challenges that determine their competitiveness in a global environment marked by innovation and sustainability. A recent meeting titled "Challenges and Solutions for the Current Spanish SME," organized by the newspaper EXPANSIÓN in collaboration with Banco Sabadell, highlighted the importance of financing, digitalization, and talent as fundamental pillars for the growth of these companies. In a context where SMEs represent 99.98% of the productive fabric and generate 64.4% of employment, it is imperative that these businesses adapt and evolve. During the event held in La Coruña, Pablo Junceda, General Director of Sabadell Gallego, emphasized the need for SMEs to adopt innovative and technological solutions to face constantly changing regulations. "Failing to support them would be the biggest mistake our country and economy could make," he stated, stressing that the health of the business ecosystem is vital for economic development. Concerns about access to financing emerged as a recurring theme, becoming an obstacle for most of these companies. The importance of SMEs in Galicia was highlighted by Antonio Fontenla, President of the Confederation of Entrepreneurs of La Coruña (CEC), who pointed out that these companies are the engine of the regional economy and that the transition to a more sustainable industrial model could create a powerful industrial hub in the Coruña-Ferrol area. This change not only boosts competitiveness but is also essential to align with the expectations of a global market increasingly aware of sustainability. The forum was divided into two round tables, the first of which focused on innovation and technology as engines of growth. Alberto Fernández, head of the Acelera Pyme Office of the Chamber of Commerce of A Coruña, emphasized that the implementation of technology must align with the business strategy to optimize resources. The message was clear: innovation and sustainability are not just options, but fundamental requirements for the continuity of businesses in the market. Venancio Salcines, President of the Center for Higher University Studies of Galicia (Cesuga), shared a similar perspective, arguing that innovation must be directed towards meeting new market needs. "Sustainability is the only absolute truth," he stated, highlighting that companies that ignore this principle are destined to fall out of the economic game. Financial challenges were also analyzed in depth. Iñaki Pradera, Director of the Business Segment of Banco Sabadell's Northwest Territorial Division, highlighted the importance of working with specialists in sustainability and financing to improve access to credit. "Our clients positively value our specialized approach," he said, suggesting that closer attention to the needs of SMEs can facilitate access to financing. Additionally, practical recommendations for accessing financing were discussed. Manuel López, external financial director at Finver, emphasized the need for SMEs to work on solid and well-structured proposals to attract the attention of risk analysts. Presenting a clear and coherent business plan can make the difference between obtaining the necessary financing or not. From the Official Credit Institute, Javier Soto explained that its role is to facilitate financing through collaborations with banking entities, pointing to instruments such as the Fond-ICO Global and Fond-ICOpyme. These funds are designed to provide the necessary capital to SMEs and promote their growth in a context where access to resources has become more complicated. The director of the Financing Area of Igape, Alberto Vivero, highlighted the importance of guarantees offered in loans, suggesting that this is one of the main obstacles SMEs face when trying to obtain financing. Collaboration between banks and mutual guarantee societies is essential to overcome this barrier and facilitate the development of new business projects. Finally, Antonio Couceiro, President of the Chamber of Commerce of A Coruña, urged the need to nurture the SME ecosystem to promote its growth. Creating a favorable economic, financial, tax, and bureaucratic environment is crucial to encourage entrepreneurship and ensure that SMEs can develop their potential. In a constantly changing world, adaptability and innovation will be key for SMEs not only to survive but to thrive in the future.

Argentina Seeks To Redefine Its Foreign Policy With New Strategic Alliances.

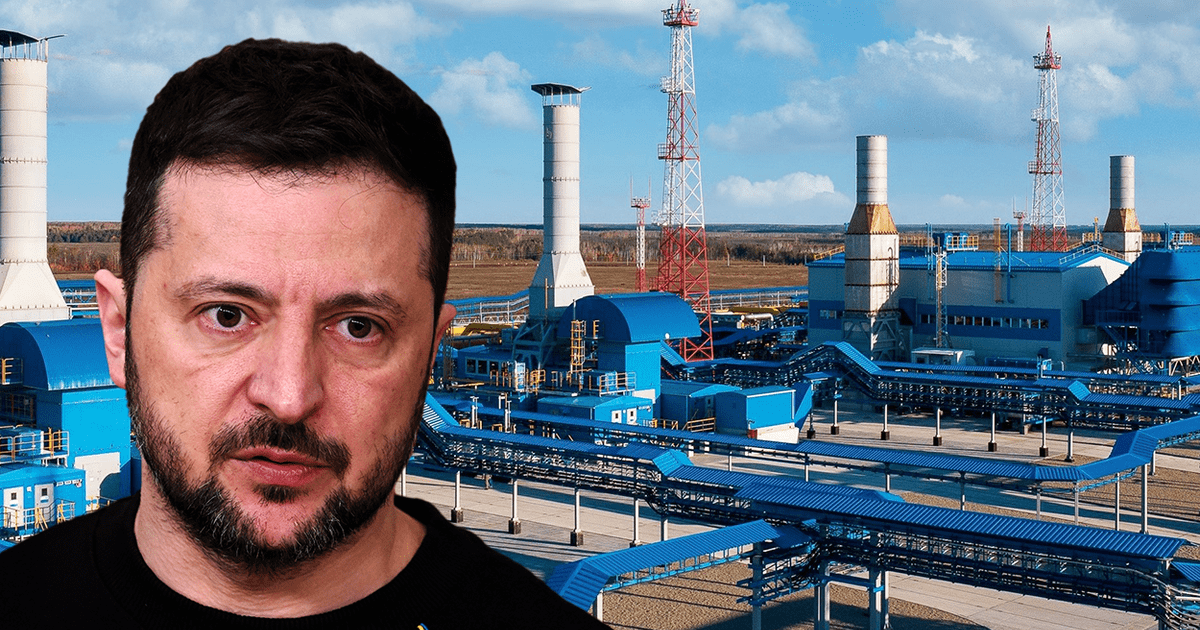

Ukraine Fulfills Warning And Cuts Off The Supply Of Natural Gas From Russia Through Its Territory.

Russian Gas Cut To Europe: The EU Activates Alternative Routes To Mitigate The Crisis.