Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

In an era where concerns about personal and property safety are felt in every corner of the country, the Superintendence of Banking and Insurance (SBS) has taken a significant step towards consumer protection. In a context marked by increasing crime rates and recent natural disasters, the proposal announced by its head, Sergio Espinosa, to free customers of banks and financial institutions from the obligation to purchase a credit life insurance has sparked a wide debate in public opinion. Credit life insurance, traditionally imposed on those who take out loans, has been a source of controversy for years. This insurance, designed to protect the lender in the event of the borrower’s death or disability, has not always been viewed favorably by borrowers. The requirement for this insurance, often considered abusive, has led many to question the ethics of banking practices. Now, the SBS is proposing an alternative that could radically change this dynamic. The SBS's proposal will allow consumers the freedom to decide whether or not to purchase credit life insurance, with the only exception being mortgage loans. This means that banks will not be able to impose an additional cost in the monthly payments of the loans, a practice that many consider unfair and which has often resulted in variable and, at times, disproportionate payments. One of the most controversial aspects of credit life insurance has been its non-refundable nature. Despite borrowers fulfilling their payment obligations, the money allocated for the insurance is not returned, leading to a widespread sense of dissatisfaction. Many customers have felt that as they meet their payments, the cost of the insurance becomes an unnecessary burden rather than a safety net in times of crisis. The SBS's proposal comes at a critical time. Concerns about the financial security of citizens are more relevant than ever, given the context of insecurity that many communities face. Allowing consumers to choose whether to purchase credit life insurance not only strengthens their autonomy but also increases transparency in banking relationships. It is important to highlight that, although credit life insurance serves a legitimate purpose, its imposition has been seen as a mechanism that favors financial institutions at the expense of consumer rights. Many citizens feel trapped in a system where they not only have to meet their debts but also an additional cost they have not freely chosen. The freedom of choice in this regard also reflects a shift in how relationships between consumers and banks are perceived. This change is a step towards the democratization of financial services, where the client is not just a number but also an actor with rights who deserves to be heard and respected. In addition to the economic implications, this change may also contribute to greater emotional peace for borrowers. Knowing that they have the option to reject an additional cost they do not wish to assume can alleviate some of the anxiety that accompanies taking out a loan. This could foster a healthier environment for responsible borrowing, where citizens can make informed and autonomous decisions. The SBS has announced that the proposal will be published on its website, allowing citizens to participate in the consultation and suggestion process before its final approval. This inclusive approach is essential to ensure that the regulations governing the financial sector reflect the needs and concerns of citizens. In conclusion, the imminent removal of the credit life insurance requirement represents a victory for consumers and a significant advancement in the regulation of the country’s financial system. As the implementation of this norm progresses, it is crucial to maintain an open dialogue between financial institutions and citizens, always seeking a balance between creditor protection and debtor rights. The hope is that this change will not only benefit consumers but also restore trust in the financial system as a whole.

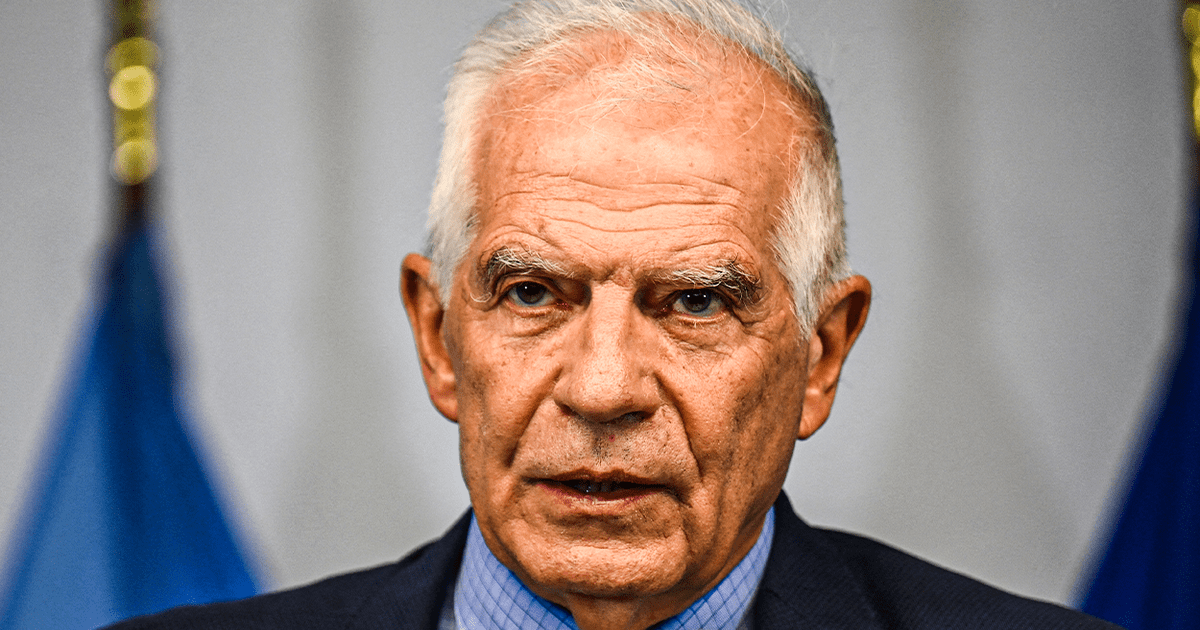

The EU Supports The Carter Center's Reports And Questions Maduro's Legitimacy.

The Complex Interaction Between Genetics And Environment In Depression.

"Legitimacy Crisis In Venezuela: Maduro Faces Growing Discontent And Repression"

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/RIDYGMOSNBHIHFYLGM3IFB7GAU.jpg)