Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

Antimony, a heavy, silvery, and brittle metal, has gained notable relevance in the global economic landscape, reaching a value of approximately $10,000 per ton. This element, which has a melting point of 630 °C and a boiling point of 1587 °C, has been used since ancient times, with records indicating that the Egyptians utilized it for cosmetic purposes. However, today its importance transcends ornamental use and has become a strategic resource in various industries, particularly in the military and technological sectors. Recently, a significant change has occurred in the antimony market, as China, the largest producer and exporter of this metal, has decided to prohibit its sale abroad. The measure, announced on September 17, 2024, has generated a flood of reactions internationally, given that countries like the United States and Russia heavily depend on this resource for their industries. China’s decision aims to ensure its own supply and avoid excessive reliance on foreign markets, a move that indicates growing concerns about the security of natural resources in an increasingly competitive world. The extraction and processing of antimony are not without considerable environmental impact. In this regard, the Chinese government has implemented stricter regulations that could influence the availability of this mineral in the global market. Additionally, it is common for the governments of producing countries to impose quotas or tariffs on exports to protect their local industries and promote domestic consumption of natural resources. This strategy can alter the dynamics of international trade, especially for nations that heavily rely on antimony imports. Currently, the United States, Tajikistan, Russia, Myanmar, and Australia are among the leading exporters of antimony worldwide. The United States, although a major importer of this metal, has initiated projects like the Stibnite project in Idaho to develop its own reserves and reduce dependence on other countries. For its part, Tajikistan has capitalized on its abundant mineral reserves, while Russia remains a key player in the market due to its rich mining history. Another country that has seen an increase in its antimony exports is Vietnam, which has worked hard in recent years to position itself as an important player in the global market. Oman and Peru, although with smaller exports in comparison, have also begun to stand out in this field, while Congo and Canada contribute to the global supply with their own reserves. With a constantly evolving market, antimony has become a strategic metal, as it is used to enhance the hardness and corrosion resistance of metals like lead and tin. Its versatility makes it essential in various industrial applications, ranging from alloy manufacturing to components in electronic devices. This diversity of uses is one of the reasons why its value has been on the rise, generating increasing interest among countries and companies. The recent announcement from China has not only altered the dynamics of antimony trade but also poses a considerable challenge for nations that depend on this metal for their industries. The impact of this decision will be felt throughout the global supply chain, and many countries are likely to seek alternatives to ensure their access to this resource. In this context, the international community is closely watching China’s movements and how they will influence the future of the antimony market. As geopolitical tensions continue to escalate, the management of natural resources like antimony becomes a critical point for the economic strategy of nations. With the economic horizon filled with uncertainties and changes, countries will need to adapt to the new realities of the antimony market and seek ways to strengthen their own independence in the supply of strategic metals. Undoubtedly, antimony has become a symbol of the struggle for hegemony in the financial and economic realm, and its ongoing story on the global stage is a reminder of the complexities of international trade in the 21st century.

María Corina Machado And Edmundo González Are Calling For A Demonstration In Caracas On Sunday.

Tuvalu Calls For Help: Its Existence Is Threatened By Climate Change.

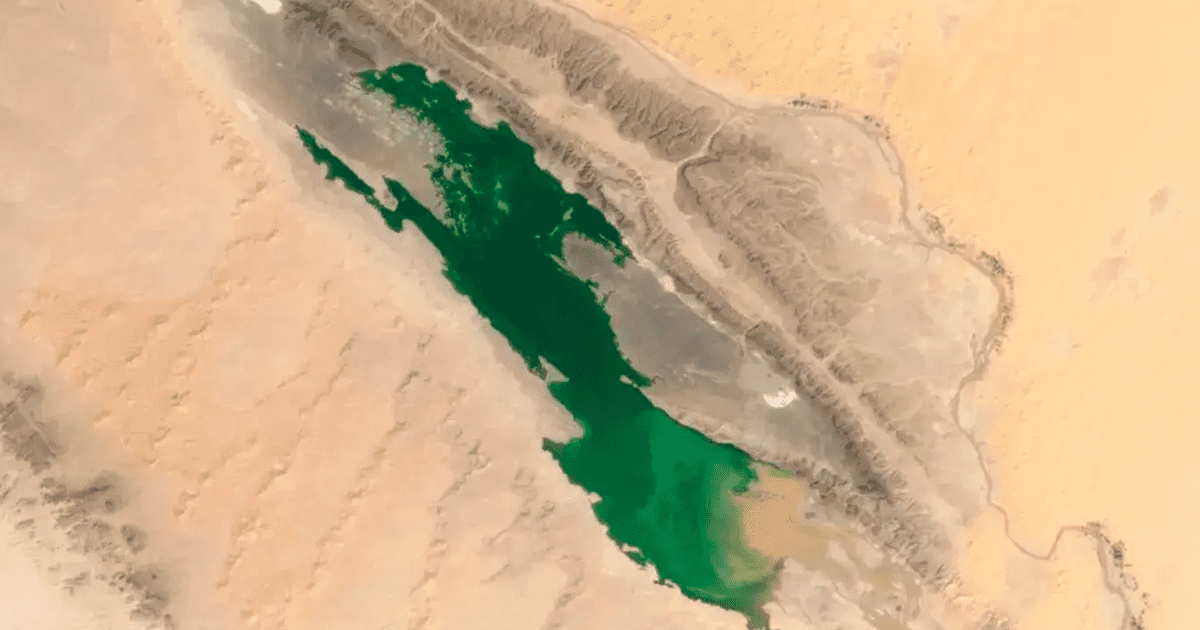

Ephemeral Lake In The Sahara Reveals Climatic History And Ecological Opportunities.