Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

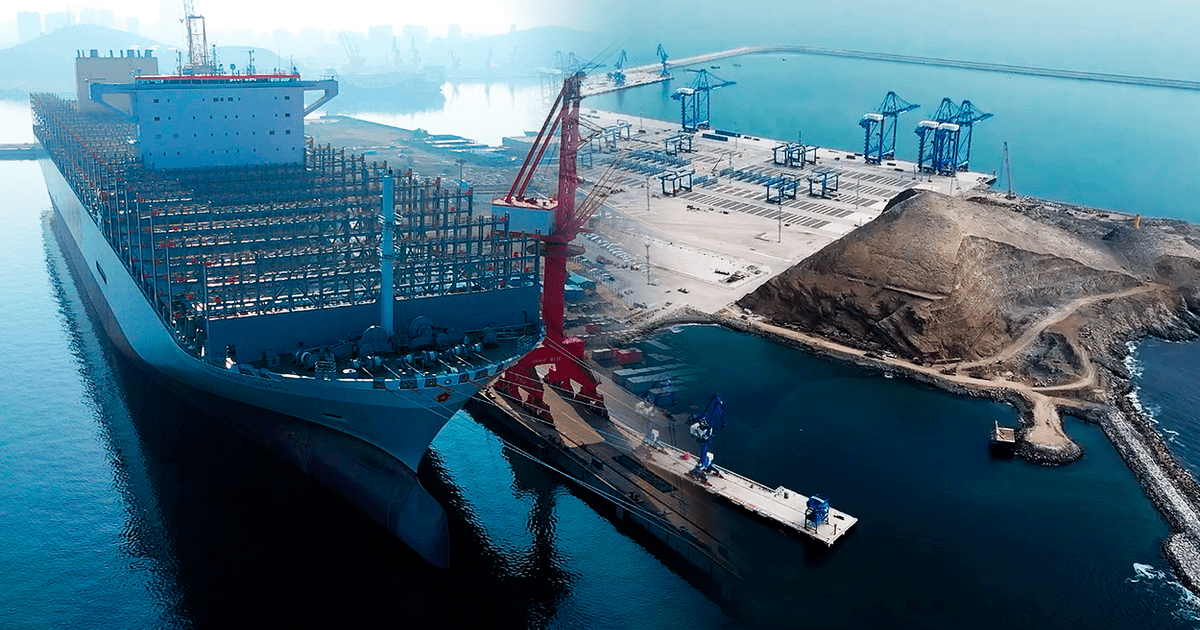

The recent proposal to establish a Special Economic Zone (SEZ) in Chancay has sparked intense debate in the country. With the imminent inauguration of the Chancay megaport, the possibility of exempting the Income Tax (IR) in this area has been raised, leading to questions about whether it is a necessary incentive to attract investments or, conversely, a tax gift that could compromise the country's finances. Business groups have proposed that the IR rate start at 0%, with gradual increases starting from the fifth year. However, the Government has not yet made a firm decision on this matter, although there is considerable internal support for a possible total exemption. This scenario has led former economy ministers and representatives of industrial associations to express their views on the potential effects this measure could have. Carlos Oliva, former Minister of Economy, has stated that the idea that companies will not come to Peru if the IR is not set at 0% is “false.” According to him, companies will be interested in the Chancay port and the SEZ for the opportunities they offer, regardless of the tax burden. Oliva argues that the tax exemption makes no sense, as if companies do not pay taxes in Peru, they will pay them in their home countries. Therefore, the proposal could not only be counterproductive but also favor unfair competition with local businesses. Antonio Castillo, a representative of the National Society of Industries (SNI), has defended the proposal for an initial IR of 0%, pointing out that many SEZs around the world, even in developed countries, have opted for this strategy to attract investments. Castillo mentions that if Peru does not adapt to these standards, it could lose its competitiveness against nations like Chile and Ecuador, which are already implementing more attractive fiscal policies for international investors. Luis Miguel Castilla, another former Minister of Economy, has warned about the risks of a possible exemption. According to him, it is not enough to have tax incentives to attract investments; it is crucial to improve the general conditions of the country, such as transportation and security. Castilla has also warned about the state of fiscal accounts, alerting that a decrease in revenue due to the exemption of the IR could worsen the country's economic situation. From the Association of Exporters (ADEX), Julio Pérez has emphasized the need to create attractive conditions for investment. Pérez suggests a gradual approach, starting with 0% and increasing to figures closer to the international average within a reasonable timeframe. In his view, what will really generate jobs will be the development of activities around the port, not the megaport itself. The debate over the exemption of the IR in the Chancay SEZ reflects a tension between the needs for economic development and the fiscal sustainability of the country. While it is undeniable that attracting investments is fundamental for economic growth, it is also crucial to consider the long-term implications of fiscal policies that could jeopardize state resources. Critics of the proposal warn that allowing a total exemption could set a dangerous precedent, where other sectors also demand tax reductions. This situation could erode the country's tax base and limit the Government's ability to finance essential public services and social programs. The implementation of this SEZ will not only have an immediate impact on the business sector but could also influence the country's perception on the international stage. If the tax conditions are perceived as unfavorable or unfair, it could affect Peru's image as an attractive destination for foreign investment. As the Congress of Peru faces this dilemma, the need for in-depth analysis and informed debate becomes more pressing. The decisions made in the coming days will have significant repercussions on the national economy and the country's ability to compete in an increasingly challenging global environment. The conversation should not only revolve around the immediate benefits of investments but also focus on building a sustainable future that benefits all Peruvians.

Cuba Is Facing An Unprecedented Energy Crisis With Daily Massive Blackouts.

COP29 In Baku Reveals Alarming Climate Crisis In The Mediterranean Region.

"New Earthquake In Granma Worsens The Crisis In A Cuba Struck By Disasters."