Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

The Association of Gas Stations and Service Stations of Peru (Agesp) has raised the alarm over what they consider a concerning interpretation by Osinergmin regarding the Extracontractual Civil Liability Policies required for hydrocarbon marketing activities nationwide. According to Agesp, this new interpretation is causing problems that jeopardize the entire hydrocarbon marketing chain in the country. In a recent statement, Agesp expressed concern over the inspections being carried out by Osinergmin, in which it has been observed that the extracontractual liability insurance policies do not comply with the sectoral regulations issued by the Ministry of Energy and Mines. The association argues that it is legally impossible to cover situations arising from non-compliance or omissions of regulations by the insured or the administration, as insurance is designed for unforeseeable situations and not for intentional acts against public order. Apeseg, the Peruvian Association of Insurance Companies, supported Agesp's position in a letter to the regulatory body, indicating that the current conditions of the insurance policies are in line with the Insurance Contract Law and cannot stipulate the loss of rights of the insured for violation of regulations, unless such violation constitutes a crime or the cause of the claim. It is emphasized that the existing insurance policies have been approved and registered with the Superintendence of Banking, Insurance and Pension Fund Administrators. The new interpretation by Osinergmin regarding the requirement for insurance policies to cover losses due to regulatory non-compliance has raised concerns in Agesp, as they believe this not only affects the legal stability of the holders of hydrocarbon marketing activities but also jeopardizes fuel supply at different points in the country. This interpretation could lead to fuel shortages, as the requirement for additional coverage in the insurance policies is not available in the local insurance market. In response to this situation, Agesp has urgently requested the Ministry of Energy and Mines, as well as Osinergmin, to establish working groups to adopt measures that meet the sector's needs and are based on technical foundations. The association aims to establish a uniform legal criterion that guarantees legal certainty in hydrocarbon marketing activities and avoids potential negative impacts on fuel supply in the country. In conclusion, the discrepancy between Agesp and Osinergmin regarding the interpretation of extracontractual civil liability insurance policies is generating uncertainty in the hydrocarbon marketing sector in Peru. It is essential that the competent authorities work together with the industry and the insurance market to find a solution that ensures legal certainty without compromising fuel supply in the country.

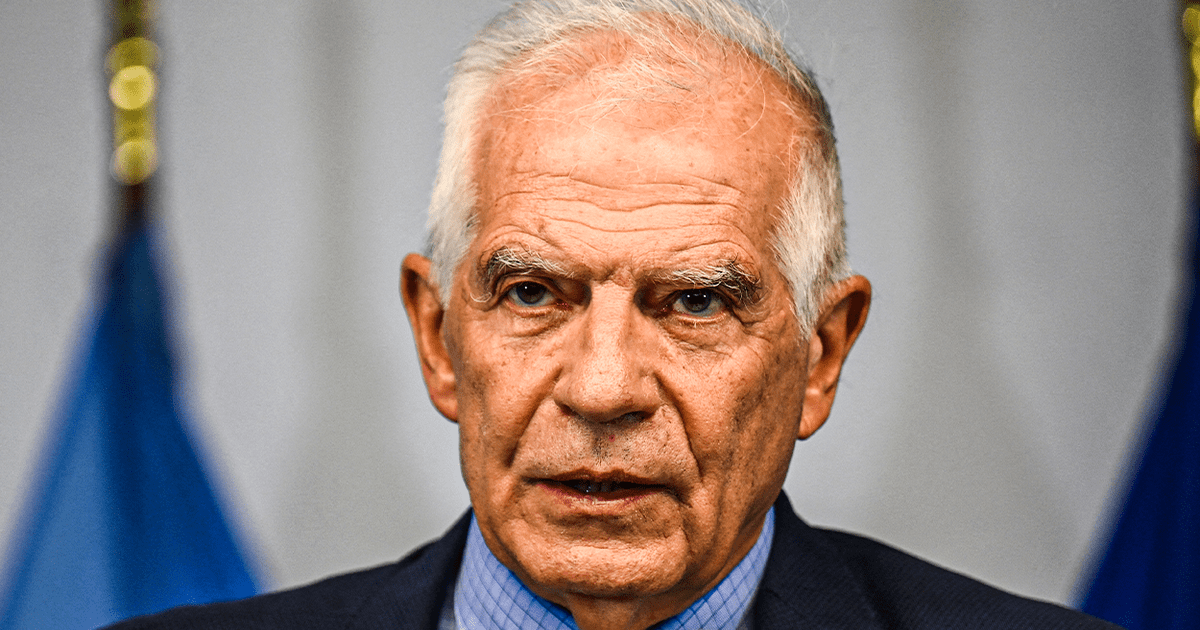

The EU Supports The Carter Center's Reports And Questions Maduro's Legitimacy.

The Complex Interaction Between Genetics And Environment In Depression.

"Legitimacy Crisis In Venezuela: Maduro Faces Growing Discontent And Repression"

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/RIDYGMOSNBHIHFYLGM3IFB7GAU.jpg)