Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

In a constantly evolving world, the intersection between technological change and tax policy becomes more critical than ever. Peru, with its low tax pressure compared to the rest of Latin America, faces a significant challenge: the need to finance public goods and services in a context of increasing informality and deteriorating citizen security. This situation not only affects the state's ability to collect revenue but also jeopardizes the well-being of the population that depends on these services. Informality is a deeply rooted phenomenon in the Peruvian economy, creating a "fiscal hole" that worsens in times of political uncertainty. In this scenario, expanding the tax base is essential, but it must be accompanied by an approach that simplifies the life of the taxpayer. The demands from the business sector, although diverse in their foundation, indicate the need for constructive dialogue between the state and the private sector to find viable solutions. However, the current context invites us to look beyond immediate solutions. The rapid pace of technological change, driven by innovations such as artificial intelligence, presents challenges that require deep reflection on the future of tax policy. The automation of repetitive tasks could lead to a complex transition in the labor market, where many jobs may disappear while new ones will emerge. This labor reorganization will entail a temporary fiscal revenue gap, necessitating proactive planning and an adaptive tax policy. A simplistic solution might be to tax artificial intelligence and its tools, but such a decision would be counterproductive. Emerging technologies are engines of productivity that, when encouraged, can generate greater long-term tax revenues. A more intelligent approach would be to promote the use of these tools, allowing economic growth to offset the short-term decline in revenue. State intervention will be key to ensuring employability and mitigating the effects of these transformations in the labor market. The case of digital services is another clear example of the need for a flexible tax policy. The recent controversy surrounding taxes on entertainment platforms demonstrated the tension between the need to collect revenue and the impact on consumers. In this context, it is essential to find a balance that allows for adequate taxation of sectors such as digital betting, which are booming but lack appropriate tax regulation. Moreover, the temporary accommodation sector presents similar challenges, where platforms operating in this area must be subject to taxes that ensure fair competition with hotels that meet their tax obligations. The discussion on how to properly regulate these new forms of commerce is essential to ensure that the growth of tourism benefits all stakeholders involved. Additionally, the shift towards electric vehicles and the reduction of revenue from the Selective Consumption Tax (ISC) on fuels presents a scenario where the positive externalities of sustainability must be recognized. Promoting the use of electric vehicles can justify the creation of subsidies to encourage their adoption, while adjusting tax policies to avoid a sudden drop in fiscal revenues. The need to establish a fiscal framework that considers these emerging realities is imminent. It is crucial that the debate begins now, anticipating the changes to come. Those states that manage to adapt quickly to new technological paradigms will be in a better position to meet the needs of their populations and ensure sustainable development. In conclusion, the future of tax policy in Peru requires a proactive vision that considers the impact of technological change. As the world progresses, challenges multiply, and the state's capacity to collect resources must adapt to the new reality. Reflection and dialogue are fundamental to building a tax system that not only responds to current demands but also prepares for future challenges. The key lies in acting with foresight and flexibility, ensuring that technological changes become opportunities for growth and development for the country.

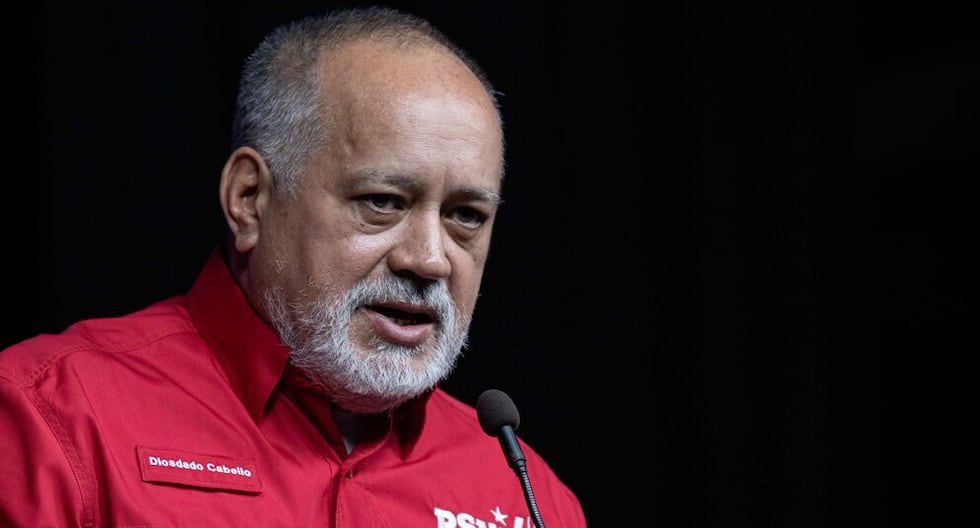

Members Of Los Piratas Are Arrested In Chile For The Kidnapping Of A Former Venezuelan Military Officer.

Chile Accuses Chavismo Of Hiring The Tren De Aragua To Kill An Asylum-seeking Opposition Member.