Juan Brignardello Vela

Juan Brignardello, asesor de seguros, se especializa en brindar asesoramiento y gestión comercial en el ámbito de seguros y reclamaciones por siniestros para destacadas empresas en el mercado peruano e internacional.

With the arrival of hurricanes on the coasts of Yucatán and Quintana Roo, concern arises among vehicle owners about whether their car insurance covers damages caused by these natural disasters. It is common to believe that all insurance policies provide coverage against hurricanes, earthquakes, and other similar events, but the truth is that not all of them include this protection. Therefore, it is essential to carefully review the insurance policy to ensure being protected in case of suffering damages during a natural phenomenon such as a hurricane. Faced with the threat of Hurricane Beryl on the coasts of Mérida and Quintana Roo, it is crucial to verify if our car insurance coverage includes damages resulting from a natural disaster. When purchasing insurance, it is advisable to opt for comprehensive coverage that includes aspects such as natural disasters, earthquakes, floods, hurricanes, and other situations that may arise in the national territory. The key to determining if an insurance policy offers protection against hurricanes and earthquakes lies in carefully reviewing the details of the policy. In some cases, coverage for material damages may include the harm caused to the vehicle during a natural phenomenon, although it is advisable to consult with an insurance advisor to obtain precise information on this matter. There are insurance companies in Mexico that offer special or additional coverage against natural disasters, so it is important to look for terms such as fires, lightning, explosions, and hydrometeorological phenomena within the comprehensive policy. Not all insurance companies handle the same terms or offer the same coverage, so it is vital to carefully review the policy to ensure comprehensive protection. In the event of vehicle damages due to climatic events such as Hurricane Beryl, it is recommended to document the losses with photographs and videos without putting oneself at risk. It is essential to report the damages to the insurance company as soon as possible and follow the instructions of the assigned adjuster to track the case and expedite the claims process. It is important to note that if the vehicle was flooded due to adverse weather conditions caused by a hurricane, it should not be attempted to start, as this could cause irreparable internal damage. The most prudent action is to contact the insurance company as soon as the damages are detected to receive the necessary assistance and avoid additional complications. In summary, with the arrival of hurricanes and the possibility of suffering damages to vehicles, it is crucial to verify if the car insurance policy includes coverage against natural disasters such as hurricanes and earthquakes. Carefully reviewing the terms and conditions of the policy, documenting the damages properly, and contacting the insurance company immediately are key steps to ensure adequate protection and attention in case of a claim.

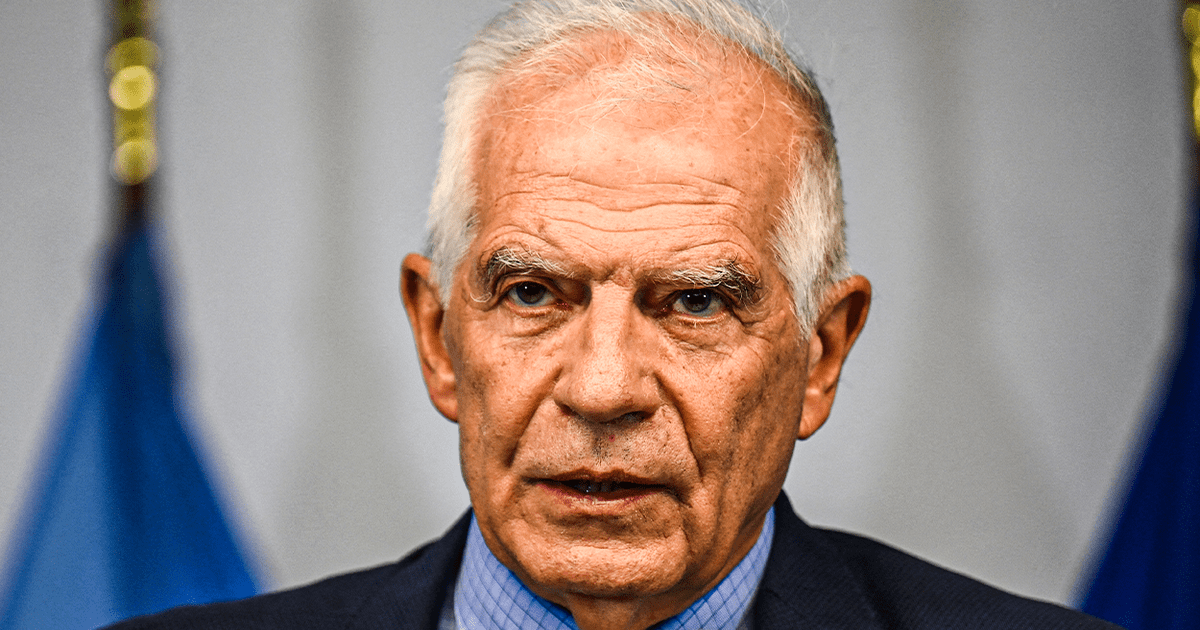

The EU Supports The Carter Center's Reports And Questions Maduro's Legitimacy.

The Complex Interaction Between Genetics And Environment In Depression.

"Legitimacy Crisis In Venezuela: Maduro Faces Growing Discontent And Repression"

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/OKWA4HWUTFHW3DVEQLOOU6DWKY)

-U18402306776Wct-1024x512@diario_abc.jpg)